Sworn Statement in Proof of Loss free printable template

Fill out, sign, and share forms from a single PDF platform

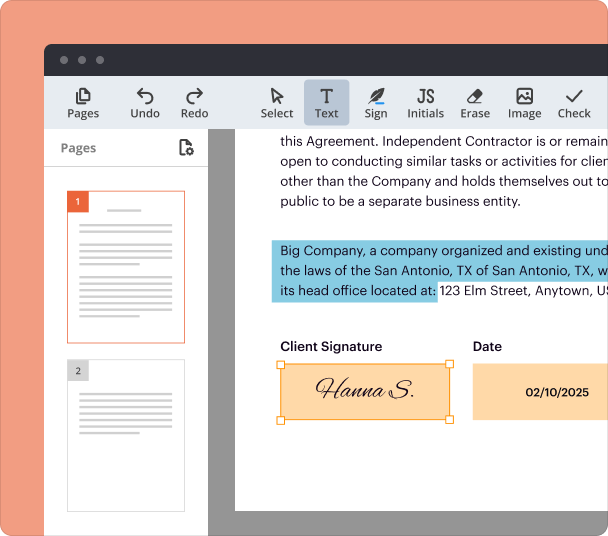

Edit and sign in one place

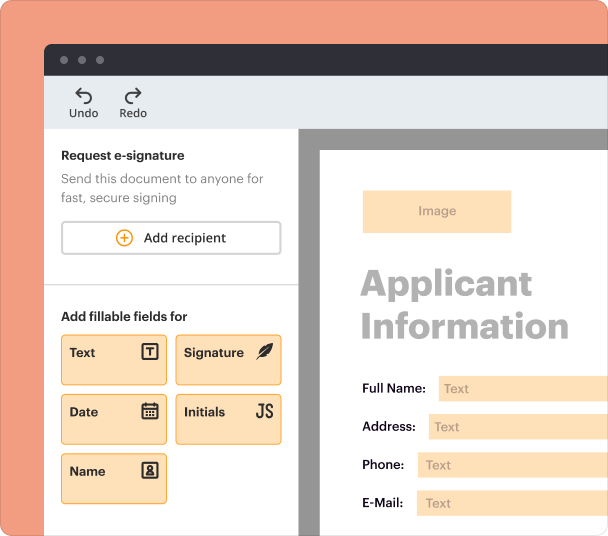

Create professional forms

Simplify data collection

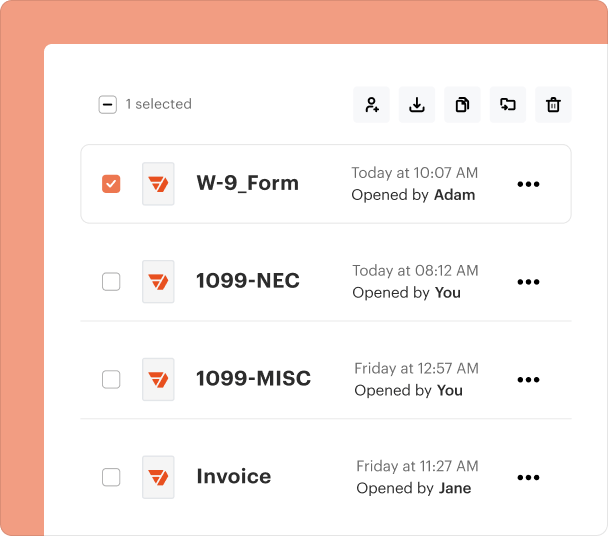

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

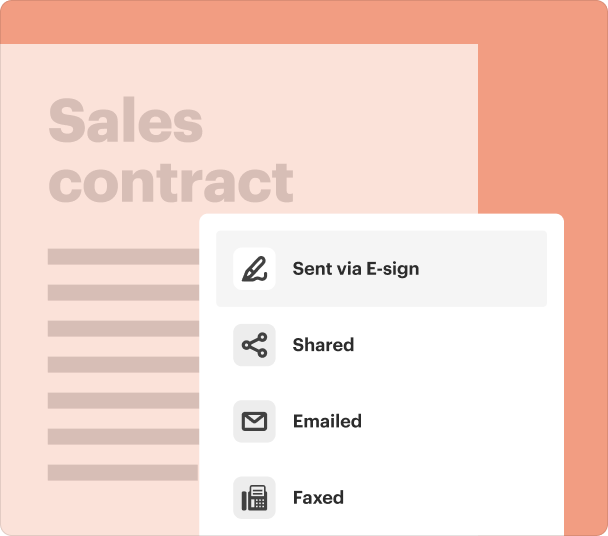

End-to-end document management

Accessible from anywhere

Secure and compliant

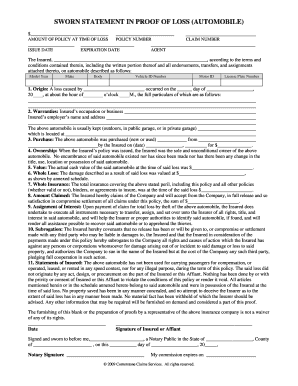

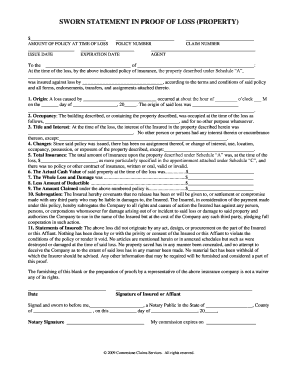

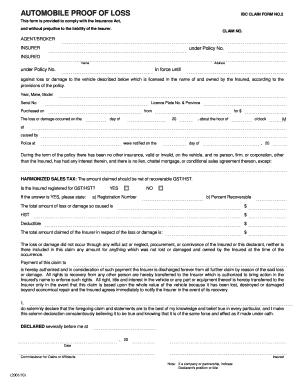

Understanding the Sworn Statement in Proof Form

Definition of the sworn statement in proof form

A sworn statement in proof form is a formal document used in the context of insurance claims. It serves as a declaration by the policyholder regarding the details of a loss or damage incurred. This statement is crafted to convey the facts related to the incident, affirming its authenticity through the policyholder’s signature and oath.

Key components of the sworn statement

The sworn statement includes several essential components that must be addressed for it to be valid. These components consist of the policy number, details of the loss, the value of the damaged property, and a declaration that the loss did not result from the policyholder's misconduct. This transparency helps ensure that the claims process is straightforward and based on accurate information.

Filling out the sworn statement accurately

To complete the sworn statement, it is crucial to provide accurate and detailed information. Begin by entering the policyholder's information, followed by the specifics of the loss, including date, time, and cause. Clearly state the value of the property at the time of loss and ensure that you disclose any other individuals with an interest in the property. Review the form for completeness and clarity before signing it.

When to utilize the sworn statement in proof form

Typically, the sworn statement is employed when a policyholder reports a loss that requires validation for an insurance claim. This includes instances of property damage due to various causes. It is essential to submit this document promptly after the loss occurs to facilitate a timely claims process. Engaging with the sworn statement ensures that the insurance company has the necessary information to assess and process the claim effectively.

Common pitfalls to avoid

When filing a sworn statement, it is important to avoid common errors that can delay the claims process. Ensure that all fields are filled out completely and accurately. Double-check the facts regarding the loss, including dates and descriptions. Avoid omitting any details that could be significant to the claim. Neglecting these aspects can lead to complications or even rejection of the claim, so thoroughness is essential.

Validation and review considerations

Before submitting the sworn statement, it is advisable to review the document for consistency and completeness. Consider having a trusted advisor or legal representative review it if there are any uncertainties. Ensuring that the information is accurate and comprehensive can help prevent delays in claim processing and affirm the legitimacy of the statement provided.

Frequently Asked Questions about property proof loss fillable form

What is the purpose of a sworn statement in proof form?

The purpose of a sworn statement in proof form is to provide a formal written declaration to an insurance company, detailing a loss or damage that has occurred, thereby facilitating the claims process.

Who is responsible for completing the sworn statement?

The policyholder is responsible for completing the sworn statement, providing accurate information regarding the loss, and signing the document to affirm its authenticity.

How does one ensure the sworn statement meets legal requirements?

To ensure the sworn statement meets legal requirements, it is important to adhere to any specific local regulations and to provide complete, honest, and concise information about the loss, verifying facts and including necessary signatures.

pdfFiller scores top ratings on review platforms